By including Cancer Support Community San Francisco Bay Area (CSC SF Bay Area) in your estate plan, you can combine your desire to give to charity with overall financial, tax, and estate planning goals. You also become a member of Shannon McGowan’s Legacy Society. Shannon McGowan, the founder of CSC SF Bay Area (formerly the Wellness Community), served as the Program Director for the first Wellness Community, based in West Los Angeles, and was a pioneer in the integrative therapies and cancer patient empowerment movement in the United States. Shannon impacted the lives of thousands of cancer patients and their families throughout California and the nation and left her legacy of caring and support that still exists today.

About Bequests

This is a flexible way to leave a meaningful gift to Cancer Support Community San Francisco Bay Area (CSC SF Bay Area). Choose a way that works best for you while providing value to cancer patients and their loved ones, free of charge.

Ways to Bequest

- Gift a dollar amount or assets

- Gift a percentage of your estate

- Gift from the balance or residue of your estate

- Designate a beneficiary of certain assets

What are my benefits for making a bequest to Cancer Support Community?

- It’s an easy way for you to leave a lasting legacy your loved ones will be able to see working for our missions

- You lessen the burden of taxes

- You may receive estate tax savings

IRA Charitable Rollover

This is a great option for a donor to reduce taxable income directly from the IRA, for people 70 1/2 and older and fulfill charitable goals.

How?

- Contact your IRA plan administrator to make a gift to CSC SF Bay Area, or choose the “Make a Gift From My IRA” tool to contact your custodian. Gift a percentage of your estate

- Your IRA funds will be directly transferred to CSC SF Bay Area where we will acknowledge your generosity as a qualified charitable distribution.

What are my benefits of an IRA charitable rollover?

- Avoid taxes on transfers of up to $100,000 from your IRA to CSC

- Satisfy your required minimum distribution for the year

- Reduce your taxable income

- Ultimately help keep CSC’s mission free of charge

Ways to Give

There are many ways to offer your planned giving to CSC SF Bay Area, and how to maximize your gift for you and your loved ones.

How?

- Stocks and Bonds

- Gifts of Real Estate

- Gift of Retirement Assets

- Gifts of Cash

- Gifts of Insurance

Legacy Advisory Council

To get your planned giving questions answered, contact Andy Dunn, Senior Development Manager, for a no-pressure conversation and an introduction to our CSC’s Legacy Advisory Council. The Council is comprised of local experts in the field of financial and estate planning and are a great resource for our community.

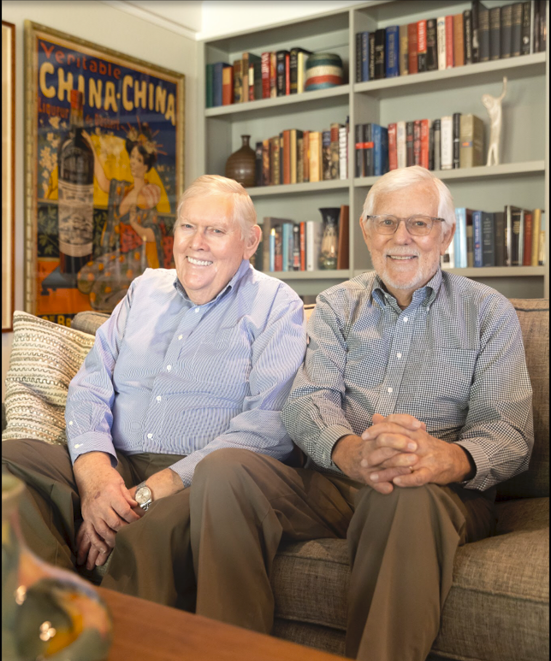

Leaving a Legacy: Our Values live on through our $1 million gift

David Bohne and Thomas Bye have pledged an incredible legacy gift to Cancer Support Community. Their dedication to supporting people impacted by cancer, like themselves, will live beyond their years. Learn more about David and Thomas’ story here.

To learn more about how to leave your Legacy for future patients and their loved ones contact Andy Dunn, Senior Development Manager, at 925.953.1213 or adunn@cancersupport.net.

If you are planning a gift to CSC SF Bay Area in your trust, bequest, or other gift, please designate it to “Cancer Support Community San Francisco Bay Area.”

Tax ID: 68-0157858